Ending NYS’ Stock Transfer Tax Rebate Would be ‘Audacious’—Why is Mayor Mamdani Ducking it?

The State of New York has rebated approximately $600 billion to Wall Street since 1981. Gubernatorial hopeful Antonio Delgado wants to change that—but New York City Mayor Zohran Mamdani isn’t on board.

By Joe Maniscalco

“Beginning today we will govern expansively and audaciously,” New York City Mayor Zohran Mamdani pledged during his inauguration speech on Jan. 1.

So, why is he continuing to run away from the New York State Stock Transfer Tax Rebate and letting Lt. Governor Antonio Delgado show what audacity really looks like?

A couple of weeks before Mayor Mamdani took the oath of office, gubernatorial hopeful Antonio Delgado took to social media to pledge his support for repealing the New York State Stock Transfer Tax Rebate—a move economists now say could generate anywhere between $40 to $75 billion annually in additional tax revenues to benefit the urgent needs of all New Yorkers.

“For decades, Wall Street has made billions off New Yorkers—and paid nothing in stock transfer taxes. It’s time to collect the revenue already on the books and invest it back into our schools, transit, and communities. Let’s make the ultra-wealthy pay what they owe,” Delgado wrote in a Dec. 22, 2025 post on X.

Now, contrast that with newly-elected Mayor Mamdani’s plan to raise the personal income tax on the wealthiest one-percent of New Yorkers by 2%— and increasing the state’s top corporate tax to 9%—matching what the State of New Jersey is doing.

Together, the new taxes might bring some $9 billion to New York City coffers every year.

But repealing the New York State Stock Transfer Tax Rebate could deliver a whole lot more than that. Just the New York City Housing Authority [NYCHA]—currently busy privatizing prime New York City real estate in Chelsea and other parts around town—and the Metropolitan Transportation Authority [MTA] alone—could garner as much as $3.75 billion and $7.5 billion respectively every year.

In NYCHA’s case, that money would be directed to the sole purpose of protecting Section 9 Housing.

New York State collected the Stock Transfer Tax—just a measly one-tenth of one-percent on the sale of stocks—for 75 years from 1901 until the start of the “Regan Revolution” in 1981 when then-Governor Hugh Carey and Mayor Abe Beame teamed up to help kill it.

Well, they didn’t actually kill the Stock Transfer Tax. What they did back then was help make sure it was entirely rebated back to Wall Street after being collected. Advocates of finally repealing the Stock Transfer Tax Rebate in 2026 say that nifty little move made five decades ago has pushed hard-pressed New Yorkers deep into austerity while costing them approximately $600 billion in the years since.

Lieutenant Governor Antonio Delgado wants to finally end the New York State Stock Transfer Tax Rebate.

“Ending the Stock Transfer Tax rebate is the most important state legislation to pass in 2026 that would absolutely advance the safety and wellbeing of all New Yorkers for decades to come,” Ray Rogers, director of the End the Stock Transfer Tax Rebate Campaign said in a recent statement. “Passage would significantly meet the funding needs to maintain and expand public services that are on the minds of everyone—especially in light of President Trump’s reprehensible funding cuts directed at New York.”

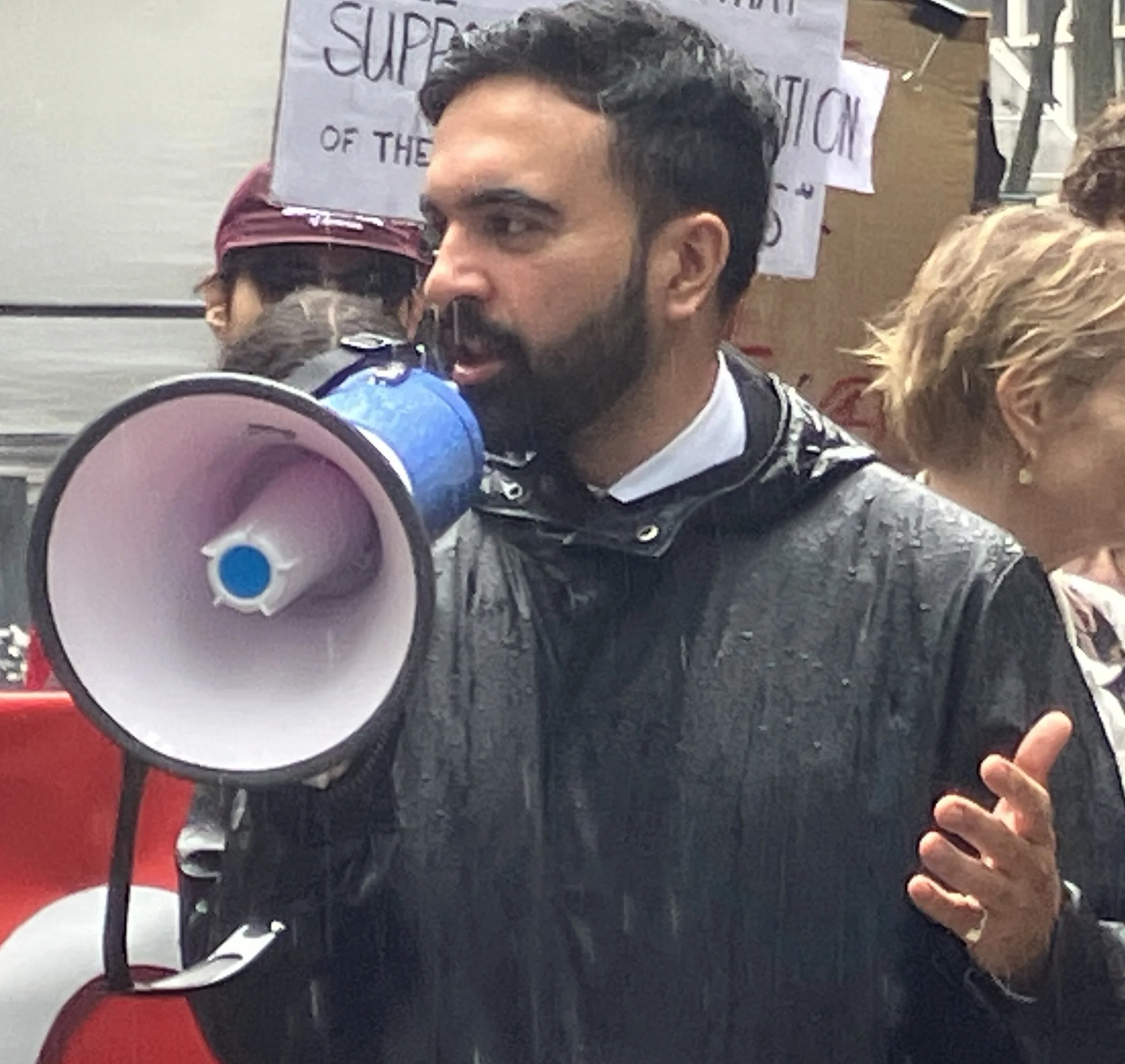

Then-mayoral candidate Zohran Mamdani speaks to supporters at Bryant Park on June 14, 2025. Photo/Joe Maniscalco

Two bills [S1237/A1494B] in the New York State Legislature sponsored by State Senator James Sanders, Jr. [D-10th District] and Assembly Member Phil Steck [D-110th District] aim to do just that.

Three new legislators have recently signed on to the Assembly bill—Manny De Los Santos [D-72nd District], Jordan Wright [D-70th District], and Steve Raga [D-30th District]—adding traction to the effort.

“These bills to end the rebate will significantly help resolve the funding crises and lessen tensions plaguing residents in public and moderate income housing in Mitchell-Lama and NYCHA complexes which house hundreds of thousands of residents and potential voters,” Rogers added.

Mayor Mamdani, however, was not among the Assembly bill’s sponsors when he served as the representative from Astoria, Queens and he isn’t pushing it now.

Work-Bites contributor Bob Hennelly pressed then-Mayor-elect Mamdani on his stance toward ending the Stock Transfer Tax Rebate at a press conference held in lower Manhattan just days before being sworn in.

Would Mayor Mamdani consider lobbying Albany to end its decades-old practice of rebating back to Wall Street the state’s Stock Transfer Tax? Hennelly wanted to know.

“My focus on raising additional revenue is on raising the personal income tax on the top one percent of New Yorkers by two percent and increasing the state's top corporate tax to match that of the top tier of New Jersey's corporate tax,” then-Mayor-elect Mamdani said in response. “I think that these are critically important as we fight to fully fund our city agencies and fund our affordability agenda.”

Delgado’s campaign couldn’t be reached for comment prior to publication of this story, so we’ll have to wait and see what the candidate hoping to unseat Kathy Hochul as governor thinks about Mamdani’s lack of support for ending the Stock Transfer Tax Rebate.

In addition to the aforementioned boost to NYCHA and the MTA—advocates for ending the Stock Transfer Tax Rebate say the New York State Department of Health could see as much as $7.5 Billion in new revenues annually, while the City University of New York [CUNY] could see as much as $1.87 billion every year.

Billions more would be further earmarked for the State University of New York [SUNY]; SWAP [Safe Water and Infrastructure Action]; AIM [Aid and Incentives to Municipalities]; Housing and Community Renewal, Department of Education; Clean Energy, Highways and Bridges, and Amtrak.

“In the 1970s, Wall Street used phony threats to pressure then‑Governor Carey and Mayor Abe Beame into refunding sales tax on stock transactions to financial power brokers,” veteran New York City community activist and ending the Stock Transfer Tax Rebate advocate Judy Jorrisch said. “Since then, politicians have quietly returned roughly $600 billion to Wall Street, while the rest of us have endured almost five decades of austerity budgeting for vital services. It is criminal to allow these unjustifiable refunds to continue for another day.”

During his inauguration speech, Mayor Mamdani further talked about New York’s sad record of allowing “moments of great possibility” to be “promptly surrendered to small imagination and smaller ambition.”

“What was promised was never pursued, what could have changed remained the same,” the new mayor said. “For the New Yorkers most eager to see our city remade, the weight has only grown heavier, the wait has only grown longer.”

One of the first things Mayor Mamdani has done in office is revoke all the executive orders former Mayor Eric Adams issued after he was indicted on federal corruption charges.

That, many will argue, was a no-brainer for a populous mayor elected on a citywide mandate to upset the status quo and tilt more power to average everyday New Yorkers. They want to see more out of him—a lot more.

During his inauguration speech, Mayor Mamdani also talked about how “this moment demands a new politics, and a new approach to power.”

Stock Transfer Tax advocates heard that pronouncement, and can’t help starting out 2026 thinking how leaving the rebate on the books flies in the face of those lofty words.

They argue that back in the early 1980’s, Hugh Carey and Abe Beam conspired to give Wall Street the gift that just keeps on giving while the rest of New York has been left to get by on lumps of coal—and that New York City Mayor Mamdani and whoever becomes the next governor of the state have the power to help reverse that action.

The overriding question they have now is what’s preventing them from really being audacious and actually doing it?