‘There’s Gotta Be a Better Way’: NYCHA Needs Money—The NYS Stock Transfer Tax Delivers it

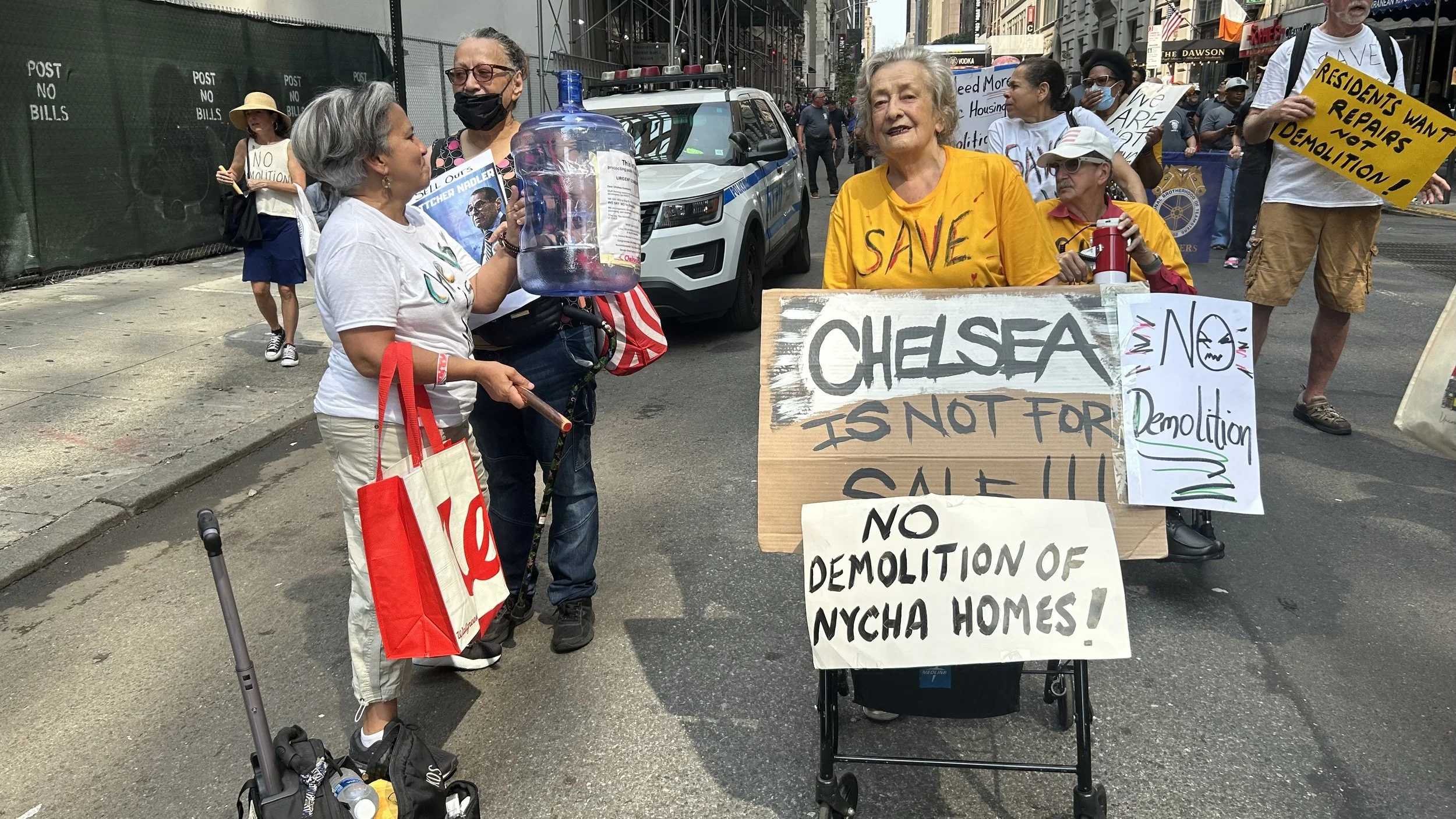

Chelsea residents Lizette Colón and Christina Ember [l to r] help lead Fulton and Elliott-Chelsea tenants fighting the demolition of their homes during this weekend’s Labor Day Parade in New York City.

By Joe Maniscalco

A couple of very important things came out of Community Board 4's Sept. 3 meeting in which members officially rejected NYCHA’s plan to turn over the Fulton and Elliott-Chelsea Houses to private developers for demolition and reconstruction.

One is that the public housing residents actually living there do not want to see their homes and community torn down in the name of “redevelopment.” The other is that there has got to be a better way for the City of New York to take care of public housing than handing over the keys to profit-driven private developers looking to make a killing.

Well, it turns out there is—but no one has the guts to do it. And that’s because in New York City, kicking senior citizens out of their homes is much easier than demanding the wealthy pay their fair share.

For more than 75 years, New York State collected a minuscule tax [half a penny back in 1905] on stock trades. The revenue helped make both the City University of New York and the State University of New York systems, as well as Mitchell-Lama housing and a bunch of other public-centered projects, possible.

The State of New York, caught up in Reagan-era economics, however started rebating the tax back to Wall Street in 1981, leaving billions of dollars on the table every year since. Fast-forward to today, and the New York City Housing Authority [NYCHA] says it’s so broke it can’t possibly deal with the mold in Chelsea’s public housing, so better to call in the private developers to knock the whole place down.

“We need to have a new thought, a new vision, and real understanding of what [public] housing is and stop using the word ‘affordable housing.’ It’s an utter embarrassment—it’s a joke at this point,” Elliott-Chelsea Houses Tenant Association President Renee Keitt told Community Board 4 last Wednesday night. “We need to make a real solution—and the solution has to go beyond just the vote [on the demolition plan]. We have to reinvest in Section 9 and public housing. We have to invest in people, invest in community—and actually care.”

Chelsea Neighbors Coalition member Lydia Andre, meanwhile, denounced NYCHA’s plan to let Related and Essence Development tear down and reconstruct the Fulton and Elliott-Chelsea Houses with the addition of 70-percent market rate housing—saying the private developers’ way “cannot be the only way” to approach public housing.

"This is not a good plan,” Andre told Community Board 4. “And for those of you who believe there is no other way to get decent, clean apartments in these buildings—it can’t be true. The Related way cannot be the only way. The privatization way cannot be the only way. Remember, Eric Adams won’t be mayor, Mark Levine won’t be borough president. Changes are coming—there will be opportunities to do something better.”

According to State Senator James Sanders, Jr. and Assembly Member Phil Steck—the two sponsors of pending bills in the New York State Legislature to repeal the Stock Transfer Tax Rebate—something better is already here.

“Enacting the Stock Transfer Tax Rebate Repeal bill into law (S.1237/SANDERS, same as A.1494-A /Steck) will provide NYCHA hundreds of millions of dollars per year to allow them with the increased capacity to improve NYCHA facilities for the benefit of the tenants,” State Senator Sanders, Jr. [D-10th District] told Work-Bites this week.

Historically, Assembly Member Steck [D-110th District] notes, private developers in NYC have utterly failed to produce any meaningful affordable housing at all.

“Those programs are all failures,” he told Work-Bites. “Public housing does the job but it requires government investment. The stock transfer tax allocates funding for that purpose.”

A new study issued in July by noted economist and tax expert James Henry, reports that because of the explosion of hundreds of billions of worldwide stock trades, 40% of which flow through New York, restoring the stock transfer tax would recoup a staggering $40 to $60 billion annually in extra revenues for the state. The bills earmark 10% of those new revenues, 5% for NYCHA and 5% for NYS Homes and Community Renewal (HCR), or at least two to three billion dollars for each every year going forward.

“The most economical, sensible and humanitarian way to prevent much emotional pain and despair around the demolition issue is to follow the sound advice of [Community Board 4 Land Use Committee member] David Holowka and NYCHA resident council leaders—which is to refurbish the structurally sound Fulton and Elliott-Chelsea Houses rather than to raze and rebuild them,” Ray Rogers, head of the campaign to repeal the New York State Stock Transfer Tax Rebate told Work-Bites this week.

Failing to act on rescinding the New York State Stock Transfer Tax Rebate, Rogers adds, only serves the interests of Real Estate Board of New York [REBNY] Chair Emeritus Stephen Ross and Board of Governors member Bruce Beal.

Beal happens to be president of Related Companies and is a trustee for Citizens Budget Committee—which is adamantly opposed to repealing the Stock Transfer Tax Rebate—while Ross, as noted here earlier, is the founder of Related Companies and owner of the Miami Dolphins football team, as well as being a mega-donor for pal Donald Trump.

Keitt told Work-Bites that she likes the idea of rescinding the New York State Stock Transfer Tax Rebate.

“The Stock Transfer Tax should be put back,” Keitt said. “Start giving money back to the people. Start funding public housing.”

As Henry also noted, much of the Stock Transfer Tax is paid by financial speculators and non-New Yorkers. And they can afford it, too. This year, speculative global stock trading will exceed $180 trillion worldwide—with at least $60 trillion a year flowing through New York exchanges.

“[Rescinding the New York State Stock Transfer Tax Rebate] therefore presents an opportunity to establish a public investment fund that can multiply the value of the tax revenues many times over,” Henry wrote earlier this summer. “This would permit us to make crucial public investments in areas like mass transit, affordable housing, health care, education, soil conservation, clean water and green energy that cannot wait.”

Embattled New York City Mayor Eric Adams has touted the so-called “public-private” partnership with Related Companies and Essence Development in Chelsea as an example of the way his administration is “rewriting the future of public housing across the city.”

And he doesn’t want to hear any talk of repealing the New York State Transfer Tax Rebate. Just last month, he defended billionaires skirting the tax while dragging out the multi-decades-old trope about how actually collecting the Stock Transfer Tax would force those benevolent billionaires to flee the state.

“So, I don't want to divide our city,” Hizzoner told the Smart Girl Dumb Questions podcast in August. “I don't want to say to billionaires, we don't want you here, because I know why we need them here. The money we make just on stock transfer taxes and bonuses, that actually impacts our budget.”

Steck responded to Mayor Adams by saying, that while he “seems to acknowledge that imposing a tax on stock transfers would generate much-needed revenue not just for New York City, but for the entire State, he is incorrect that it is currently in place.”

“Despite criticism from the New York Times that the Stock Exchange would move to New Jersey, volume on the exchange not only increased, but all other changes without a tax died out,” Steck said in a statement following the mayor’s podcast appearance. “Unfortunately, in 1981 due to Wall Street fever, the tax was eliminated, resulting in New York State losing a minimum of $14 to $16 billion in annual revenue that could have been allocated towards infrastructure, healthcare, and education.”

Legislation to repeal the New York State Stock Transfer Tax Rebate has nearly 20 cosponsors in the State Senate, and nearly 40 cosponsors in the Assembly. Curiously, Assembly Member and mayoral frontrunner Zohran Mamdani [D-36th District] is still not among them.